As the market closes at 4PM, it concludes Havergal’s first week of paper trading and algorithm forward testing. This is the first week out of roughly 10 weeks of paper trading until we will use our capital in live trading.

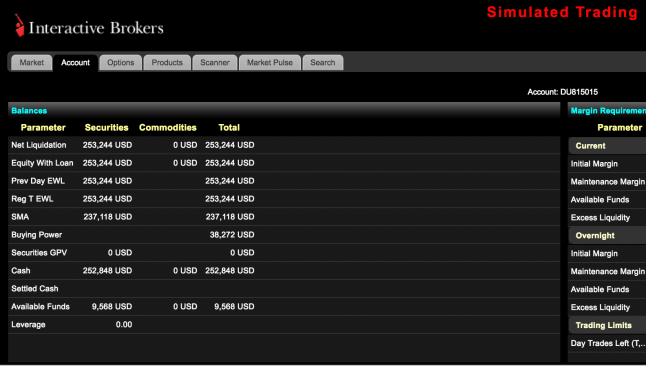

Parameters of the paper trading: We will use the same amount of brokerage commission fees as the real live trading with our prime broker: Interactive Brokers, so we can nearly completely simulate the realness of the trading. We have started the paper trading with $250,000 USD on Monday, 10/23/2017 instead of a million USD, because that is the default amount of starting cash for IBRK paper trading.

Results: One of our main strategies is using our Deep Learning algorithms to predict the underlying price movement directions and speculating on the options of such underlying. Over the course of the week, we have made $3,244 USD (1.298%) in profit, and our capital has grown from $250,000 to $253,244.

During the week the market (Dow Jones IA) has gone up from 23,348.95 (9:30AM 10/23/2017) to 23,433.18 (3:00PM 10/27/2017), which is roughly a 0.361% gain. Over the course of one week, we have nearly beat the performance of the market by a whole percent.

Reflection: We will continue paper trading over the next several months, and we will constantly change and optimize our trading strategies as we trade. It is really interesting to integrate a Machine Learning algorithm for analysis, while placing the orders manually. At Havergal, we believe that automated trading with a non-machine learning algorithm (such as mean reversion trading algorithm, etc…) provides extremely little value, because, as best, the algorithm can only be as good as the person who made the algorithm. Other than making the trading process easier, it is not very effective in generating returns above human capabilities. We use powerful deep learning algorithms to analyze the market, which predicts stock prices far above human capabilities, while reviewing the results with fundamental analysis and human judgements to filter obvious errors. We believe that is a far more effective method.

Eeeeskeeetit.