Recently, we have been working on a Recurrent Neural Network (RNN) Deep Learning algorithm using the Long Short Term Memory (LSTM) to try to predict the price of Gold over a period of 270 trading days from mid-2016 to about right now when the blog is posted.

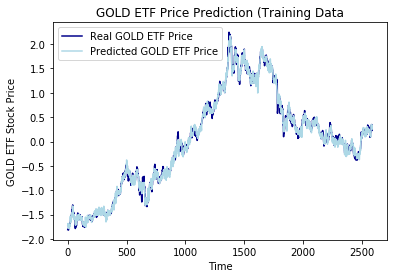

The parameters that we have used are: 10 LSTM Units, Batch_size = 32, Epoch = 500. (The regression fit on the training data have plateaued with epoch = 500)

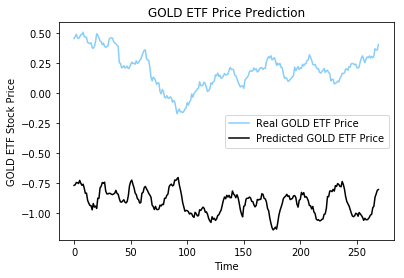

The RNN is a supervised deep learning machine learning algorithm, with long short term memory (LSTM), is highly effective for time-series analysis. We were curious to see how well it is able to predict Gold ETF price over a period of time using time-series and regression, instead of the categorical predictions done by the ANN algorithm that we have been using currently for our analysis. Today, we finished constructing a RNN algorithm for Gold, and the testing results showed that, unlike the categorical prediction, the actual price of the underlying is far more unpredictable than we have anticipated. Because of the complex pattern of the GLD underlying training data that we used to train our machine, there has been noticeable overfitting in the process. It is highly difficult to capture the randomness of the actual stock price without the machine learning algorithm over-committing to the training data, thus the algorithm developed from the training data is not effective in predicting new data it has not seen before.

The algorithm can very precisely model most of the details of the data it trains on, however when new data is being given to the algorithm, it is not predicting the future stock price with enough accuracy.

Take away from this: From this, we learned that it is ineffective trying to predict future stock price using a regression approach, because it is more prone to overfitting as well as more unpredictable. However, we do love the approach of using RNN and the LSTM time-series analysis, so we will be working on developing an algorithm for making categorical price predictions based on the RNN.

Tomorrow, we will have our first weekly trading performance report.

Eeeskeeeeetit.