This is the moment you have all been waiting for…… our first performance report on our LIVE 2 month algorithm trial period!

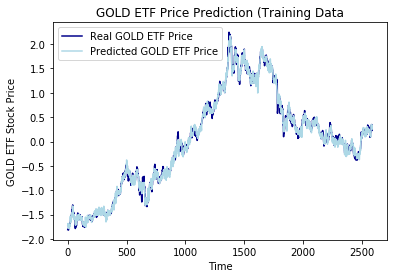

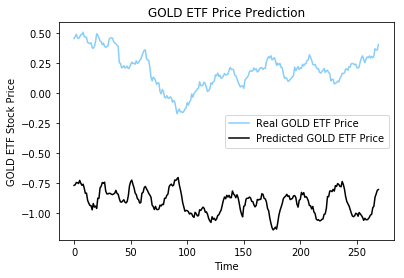

After 2 months of trading securities based on the A.I. algorithms, we have seen some incredibly surprising things. During the 1st week of trading, we only implemented our strategy #1, where we wrote options based on the predictions from the algorithm. We predicted price movement of three securities, and 2 of them are not only correct, but correct in a big way. However, because of the nature of the strategy not being Black Swan proof, that one wrong prediction (GLD ETF) caused us to lose -3% of the entire hedge fund in the first week of trading! From this, we did not benefit at all from the predicting power of the A.I., because it worked and we lost money! We realized that this strategy is not as effective as we expected it for 2 main reasons: 1st, even though with the algorithm, we can create a positive expected value, alpha, we are not protected from the high impact & low probability black swan events. We can potential be knocked out of the game. (I really don’t want to go back to being just a Whiting Engineering nerd at Johns Hopkins, haha) 2nd, we are not able to benefit from the positive Black Swan events due to the nature of the strategy. This strategy felt like playing a game of Russian Roulette, and with the algorithm, we are merely just slightly decreasing the chance of getting shot, while the benefit from not getting shot stayed the same. We have also realized that the algorithm may not be most efficiently used if we are merely using it to predict the up/down price movement a month later.

From what I saw from this, I decided to halt trading for a week to redesign the algorithm, as well as rethink the trading strategy. I changed the original algorithm into an algorithm that can be used as a tool in statistical arbitrage swing trading. The instead of predicting whether the price would be higher or lower in a month, it would now predict trend-following / trend reversal / buying or selling points, etc. I selected a pool of 30 “fundamentally strong” companies, and I used the algorithm to pick out the 5 companies that are most likely to go up in the short term, and I selected a pool of 30 “fundamentally weak” companies and used the algorithm to pick out 5 companies that are most likely to go down in the short term. I would open long positions for the 5 strong companies likely to go up and short positions for the 5 weak companies likely to go down, and I would alter or close the positions if the algorithms thinks that the companies are no longer likely to go the direction that the algorithm initially predicted. We would hold on to cash if the algorithm thinks that no opportunities arise.

Performance Report:

During the first month, the Dow Jones Industrial Average went from 24,849.63 (open price 12/29/2017) to 26,149.39 (close price 1/31/2017, which is a +5.2% gain. During this first month, we took a week and a half break to redesign the codes and strategy, so we missed out on the bull ride, as well as we lost a lot of money in the first trade of the hedge fund that went nearly belly up. After we change the strategy, Havergal’s flagship quant fund (Fraction Capital) made up for the early first week loss and ended up with +1.3% gain for the first month.

During the second month, the market enter a period of extreme volatility, where there were two 1,000+ points drop in the Dow in the same week. The Dow closed March 1st at 24,608, which is a -5.9% drop. During this period, our fund was also impacted by the volatility. However, the algorithm, which was programed for swing trading, steered the fund slightly away from the storm. Even though several of our short position candidates skyrocketed in price, (such as SNAP), and the long position companies were free-falling we still managed to not get shaken enough to flip the boat and fall into the water. Fraction posted a gain of +0.1% during arguably the craziest month of the market in years.

Overall, during the two months of live trading trial period of the algorithm, Fraction had a gain of +1.40%, while the Dow Jones Industrial Average suffered a loss of -0.98%. I have decided to halt trading after this 2 months trial, because I want to further improve the algorithm based on what I learned from the 2 months. The fund will be back in live trading soon.

“Gotta learn stuff from denial (trial) and error” – Ricky from Trailer Park Boys

– Yulin Zhu (Fund Manager) 3/3/2018