Investments heavily focused on technology, especially in the Chinese markets: Havergal_Asset_Management_LP_January_2019

Performance Report 2018-2019

Investments heavily focused on technology, especially in the Chinese markets: Havergal_Asset_Management_LP_January_2019

Here attached is our monthly performance report, reflecting our fund performance from inception (January 2018) to the end of May 2018.

Havergal Asset Management 4 Months Performance Snapshot

Please click the above link to view the 4 months snapshot of Havergal Asset Management LP. If you have any questions about our fund, please contact us.

This is the moment you have all been waiting for…… our first performance report on our LIVE 2 month algorithm trial period!

After 2 months of trading securities based on the A.I. algorithms, we have seen some incredibly surprising things. During the 1st week of trading, we only implemented our strategy #1, where we wrote options based on the predictions from the algorithm. We predicted price movement of three securities, and 2 of them are not only correct, but correct in a big way. However, because of the nature of the strategy not being Black Swan proof, that one wrong prediction (GLD ETF) caused us to lose -3% of the entire hedge fund in the first week of trading! From this, we did not benefit at all from the predicting power of the A.I., because it worked and we lost money! We realized that this strategy is not as effective as we expected it for 2 main reasons: 1st, even though with the algorithm, we can create a positive expected value, alpha, we are not protected from the high impact & low probability black swan events. We can potential be knocked out of the game. (I really don’t want to go back to being just a Whiting Engineering nerd at Johns Hopkins, haha) 2nd, we are not able to benefit from the positive Black Swan events due to the nature of the strategy. This strategy felt like playing a game of Russian Roulette, and with the algorithm, we are merely just slightly decreasing the chance of getting shot, while the benefit from not getting shot stayed the same. We have also realized that the algorithm may not be most efficiently used if we are merely using it to predict the up/down price movement a month later.

From what I saw from this, I decided to halt trading for a week to redesign the algorithm, as well as rethink the trading strategy. I changed the original algorithm into an algorithm that can be used as a tool in statistical arbitrage swing trading. The instead of predicting whether the price would be higher or lower in a month, it would now predict trend-following / trend reversal / buying or selling points, etc. I selected a pool of 30 “fundamentally strong” companies, and I used the algorithm to pick out the 5 companies that are most likely to go up in the short term, and I selected a pool of 30 “fundamentally weak” companies and used the algorithm to pick out 5 companies that are most likely to go down in the short term. I would open long positions for the 5 strong companies likely to go up and short positions for the 5 weak companies likely to go down, and I would alter or close the positions if the algorithms thinks that the companies are no longer likely to go the direction that the algorithm initially predicted. We would hold on to cash if the algorithm thinks that no opportunities arise.

Performance Report:

During the first month, the Dow Jones Industrial Average went from 24,849.63 (open price 12/29/2017) to 26,149.39 (close price 1/31/2017, which is a +5.2% gain. During this first month, we took a week and a half break to redesign the codes and strategy, so we missed out on the bull ride, as well as we lost a lot of money in the first trade of the hedge fund that went nearly belly up. After we change the strategy, Havergal’s flagship quant fund (Fraction Capital) made up for the early first week loss and ended up with +1.3% gain for the first month.

During the second month, the market enter a period of extreme volatility, where there were two 1,000+ points drop in the Dow in the same week. The Dow closed March 1st at 24,608, which is a -5.9% drop. During this period, our fund was also impacted by the volatility. However, the algorithm, which was programed for swing trading, steered the fund slightly away from the storm. Even though several of our short position candidates skyrocketed in price, (such as SNAP), and the long position companies were free-falling we still managed to not get shaken enough to flip the boat and fall into the water. Fraction posted a gain of +0.1% during arguably the craziest month of the market in years.

Overall, during the two months of live trading trial period of the algorithm, Fraction had a gain of +1.40%, while the Dow Jones Industrial Average suffered a loss of -0.98%. I have decided to halt trading after this 2 months trial, because I want to further improve the algorithm based on what I learned from the 2 months. The fund will be back in live trading soon.

“Gotta learn stuff from denial (trial) and error” – Ricky from Trailer Park Boys

– Yulin Zhu (Fund Manager) 3/3/2018

Today concludes the 3rd week of simulation trading for Havergal Asset Management. Just like the 2 weeks before this, we have made a profit. However, unlike last two weeks, the US market dropped noticeably, and that makes our performance seem even more awesome. We could have made more profit, however Yulin Zhu had 3 Johns Hopkins midterm exams during the week. Thus we were unable to open several of the profitable positions. We will be back on full throttle next week.

Our portfolio grew from $256,797 to $257,841. Which is a +0.4065% gain over the course of the week, and our total profit for the 3 weeks is +3.1364% from $250,000 to $257,841.

This week, the market dropped roughly 0.475%. We have not only beat the market this week, we have also generated a profit. Based on the 3 weeks of forward walking of the algorithm, we have seen good success. We will be finishing programming the more advanced version of the gold ETF prediction algorithm over the course of the thanksgiving break.

“2+2 is 4, minus 1 thats 3, quick maths…” – Albert Einstein Big Shaq

As the market closes in 2 hours, our second week of forward testing will come to an end. This week we have used the same strategy and stock movement prediction algorithms to make our trades. We have made a profit this week, just like last week.

Result: We have generated an even greater return compare to last week’s performance. This week our capital grew from last week’s $253,244 to $256,797. Which is a $3,553 or 1.403% gain over the course of the week. Over the course of the two weeks, our total return is $6,797, which is a 2.719% gain.

Over the course of the week, the Dow Jones IA went up from $23,405.75 to $23,550.20, which is a 0.617% gain.

Just like last week, we returns on investment have more than doubled the gains of the market. We will continue testing our algorithms, and we will also feed more data and dimensions to further improve it. We got the sauce, no ketchup; just sauce. Raw sauce.

As the market closes at 4PM, it concludes Havergal’s first week of paper trading and algorithm forward testing. This is the first week out of roughly 10 weeks of paper trading until we will use our capital in live trading.

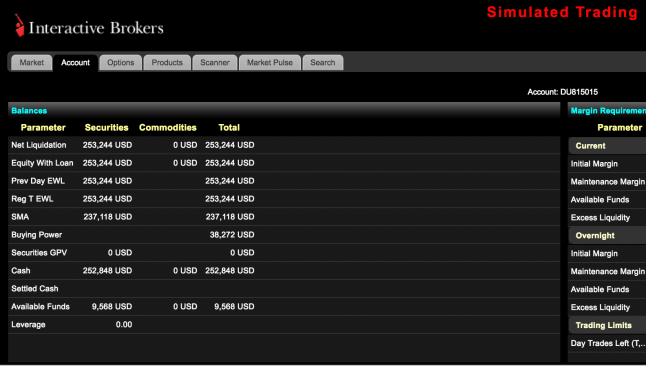

Parameters of the paper trading: We will use the same amount of brokerage commission fees as the real live trading with our prime broker: Interactive Brokers, so we can nearly completely simulate the realness of the trading. We have started the paper trading with $250,000 USD on Monday, 10/23/2017 instead of a million USD, because that is the default amount of starting cash for IBRK paper trading.

Results: One of our main strategies is using our Deep Learning algorithms to predict the underlying price movement directions and speculating on the options of such underlying. Over the course of the week, we have made $3,244 USD (1.298%) in profit, and our capital has grown from $250,000 to $253,244.

During the week the market (Dow Jones IA) has gone up from 23,348.95 (9:30AM 10/23/2017) to 23,433.18 (3:00PM 10/27/2017), which is roughly a 0.361% gain. Over the course of one week, we have nearly beat the performance of the market by a whole percent.

Reflection: We will continue paper trading over the next several months, and we will constantly change and optimize our trading strategies as we trade. It is really interesting to integrate a Machine Learning algorithm for analysis, while placing the orders manually. At Havergal, we believe that automated trading with a non-machine learning algorithm (such as mean reversion trading algorithm, etc…) provides extremely little value, because, as best, the algorithm can only be as good as the person who made the algorithm. Other than making the trading process easier, it is not very effective in generating returns above human capabilities. We use powerful deep learning algorithms to analyze the market, which predicts stock prices far above human capabilities, while reviewing the results with fundamental analysis and human judgements to filter obvious errors. We believe that is a far more effective method.

Eeeeskeeetit.